A former judge in the United Kingdom known most recently for forcing Apple (AAPL) to issue a public apology after calling Samsung's (005930) Galaxy Tab an iPad copy, has reportedly been hired by Samsung to join its legal team. Judge Robin Jacob had retired in 2011, but as FOSS Patents explains, ex-judges can still be invited to sit on the bench in the UK, and he presided over the case that ended up in a decision favoring Samsung. The South Korean company seemingly appreciated the decision - and it likely also took notice when the judge slammed Apple for having a "lack of integrity" - so Samsung has now hired Jacob to assist with its various patent battles.

[More from BGR: T-Mobile's spectacularly weird pricing strategy]

This article was originally published on BGR.com

Thursday, February 28, 2013

TuneIn's New Interface Encourages Exploration

When I listen to radio these days, what I'm listening to most often is TuneIn - the excellent website and app which collects 70,000 live terrestrial and web-only radio stations, plus two million podcasts and other on-demand audio programs. That's a lot of audio to burrow through, including music, news, talk, sports and more. And now, with new versions of its iPad app and website, TuneIn is trying to make it easier - and more fun - to find stuff you'll like.

It's doing that mostly with a feature it calls TuneIn Live. You choose up to eight radio genres - from Top 40/Pop to Drum 'n' Bass to Gospel to Progressive Talk. TuneIn then fills its home screen with eight tiles that cycle through material from the genres you selected, drawn from all of its offerings. You see the song titles or shows in question, can swipe any tile to peruse additional items in that genre and can play anything that piques your interest directly from the home screen.

The way TuneIn Live enables serendipitious discovery within sections you've specified reminds me of Flipboard's social magazine app. Its colorful, auto-updating tiles are also highly reminiscent of Windows 8 and Windows Phone 8's Live Tiles, in the interface formerly known as Metro.

TuneIn Live is slick and enjoyable, and my biggest beef is that there isn't more of it. All you get are eight tiles, which might not be enough to accommodate every TuneIn genre you're interested in. (When I first saw it, I thought I'd be able to swipe the whole screen off to the left to reveal more tiles, but no dice.)

It would also be nifty if the tiles were more customizable - if, for instance, you could pin a favorite show to the home page or specify several favorite artists, Pandora style, to create a highly personalized content stream. TuneIn's Director of Product Kristin George, told me that the company plans to expand upon this initial version, so maybe we'll see some of these tweaks eventually.

Right now, TuneIn Live is only available on the web and in the TuneIn iPad app. George told me that the company's other apps, such as ones for iPhone and Android, will be getting the feature as well. I'm looking forward to its arrival on every gizmo I use TuneIn on.

It's doing that mostly with a feature it calls TuneIn Live. You choose up to eight radio genres - from Top 40/Pop to Drum 'n' Bass to Gospel to Progressive Talk. TuneIn then fills its home screen with eight tiles that cycle through material from the genres you selected, drawn from all of its offerings. You see the song titles or shows in question, can swipe any tile to peruse additional items in that genre and can play anything that piques your interest directly from the home screen.

The way TuneIn Live enables serendipitious discovery within sections you've specified reminds me of Flipboard's social magazine app. Its colorful, auto-updating tiles are also highly reminiscent of Windows 8 and Windows Phone 8's Live Tiles, in the interface formerly known as Metro.

TuneIn Live is slick and enjoyable, and my biggest beef is that there isn't more of it. All you get are eight tiles, which might not be enough to accommodate every TuneIn genre you're interested in. (When I first saw it, I thought I'd be able to swipe the whole screen off to the left to reveal more tiles, but no dice.)

It would also be nifty if the tiles were more customizable - if, for instance, you could pin a favorite show to the home page or specify several favorite artists, Pandora style, to create a highly personalized content stream. TuneIn's Director of Product Kristin George, told me that the company plans to expand upon this initial version, so maybe we'll see some of these tweaks eventually.

Right now, TuneIn Live is only available on the web and in the TuneIn iPad app. George told me that the company's other apps, such as ones for iPhone and Android, will be getting the feature as well. I'm looking forward to its arrival on every gizmo I use TuneIn on.

Wednesday, February 27, 2013

Noted BlackBerry bull changes tune

After insisting that BlackBerry (BBRY) shares would rebound throughout 2011 and 2012 as the stock plummeted, Macquarie Capital Markets cut its price target earlier this month to $11 with a Neutral rating. This marked the first time the firm has advised investors that BlackBerry shares will likely continue to fall; Macquarie remained optimistic the whole way down over the past two years, as illustrated in the chart below. While the firm does see some positive notes for BlackBerry in the coming months, it said in a recent research note that BlackBerry shares will be trading on sentiment rather than long-term fundamentals following next month's launches, after which the stock will likely continue to slide.

[More from BGR: Crytek CEO: PlayStation 4, next-gen Xbox can't compete with PCs]

[More from BGR: Report outlines '5 biggest problems facing Apple']

"In advance of next month's BB10 launch in two of BBRY's largest markets, we are collaborating with our telecom colleagues Riaz Hyder in Indonesia and Best Waiyanont in Thailand to examine the company's opportunities and risks in emerging Asia," Macquarie analysts wrote in a recent note to investors. "We estimate that BBRY has ~15.2m subs in Indonesia and Thailand (19% of global total) and has shipped around one-third of global BB7 hardware sales in recent qtrs."

The note continued, "Our analysis shows that although the service fee structure of BB10 will be dilutive to overall service ARPU, much of the existing service revenue will be maintained for a year or more, as initial BB10 price points may be cost-prohibitive for many Indonesian and Thai consumers. We estimate that perhaps 15-20% of the BBRY installed base could purchase $400-600 ASP devices."

Macquarie sees the following impact for BlackBerry:

This article was originally published on BGR.com

[More from BGR: Crytek CEO: PlayStation 4, next-gen Xbox can't compete with PCs]

[More from BGR: Report outlines '5 biggest problems facing Apple']

"In advance of next month's BB10 launch in two of BBRY's largest markets, we are collaborating with our telecom colleagues Riaz Hyder in Indonesia and Best Waiyanont in Thailand to examine the company's opportunities and risks in emerging Asia," Macquarie analysts wrote in a recent note to investors. "We estimate that BBRY has ~15.2m subs in Indonesia and Thailand (19% of global total) and has shipped around one-third of global BB7 hardware sales in recent qtrs."

The note continued, "Our analysis shows that although the service fee structure of BB10 will be dilutive to overall service ARPU, much of the existing service revenue will be maintained for a year or more, as initial BB10 price points may be cost-prohibitive for many Indonesian and Thai consumers. We estimate that perhaps 15-20% of the BBRY installed base could purchase $400-600 ASP devices."

Macquarie sees the following impact for BlackBerry:

- Low-end BB7 devices remain popular due to lower ASPs of $200-300 vs. iPhone ASPs at $700-900 and Android ASPs at $300-800. Implicitly, we do not expect significant sales of BB10 at an estimated $500-600 ASP in emerging markets.

- The key reason for the strength of BB outside of BBM is 1) first mover advantage, 2) lower pricing point (US$200 for cheapest handset - Gemini); and 3) quite complimentary with Facebook and Twitter usage which were the main drivers for mobile internet adoption.

- According to Best Waiyanont, BBs have a considerably cheaper monthly cost than the data packages required for an iPhone or Android device. In Thailand, a BB package would cost only ~$10/month, with unlimited use of social media including Facebook, Twitter, BB messenger, and Email vs. a required data package costing $20 to support an iPhone or Android device. In the near-term, we think this will stay the BB sub base as the value proposition for BB devices is much more attractive to emerging market consumers than higher-end devices.

This article was originally published on BGR.com

Apple CEO promises investors 'great stuff' to come

CUPERTINO, Calif. (AP) - Apple CEO Tim Cook sought to reassure shareholders worried about the company's sagging stock price that the iPhone and iPad maker is on the verge of inventing more breakthrough products that will prove it hasn't lost its creative edge.

'The company is working as hard as ever, and we have some great stuff coming,' Cook told shareholders Wednesday before taking their questions during Apple's annual meeting at its Cupertino, Calif., headquarters.

True to Apple's secretive nature, Cook didn't provide any further product details, although at one point he said the company is considering entering other categories besides its popular line of digital music players, smartphones and tablet computers.

There has been speculation that Apple is working on an Internet-connected watch or TV that will be introduced later this year. One shareholder at Wednesday's meeting threw a new idea for Apple to ponder - a computerized bicycle. Cook, an avid bicyclist, chuckled at the suggestion, along with the rest of the audience.

Although there were more moments of levity, Wednesday's meeting was less celebratory than the events in past years, when Apple's stock price was soaring to the delight and enrichment of its shareholders.

Since hitting an all-time high of $705.07 five months ago, Apple's stock has plunged by 37 percent. The decline has wiped out collective shareholder wealth totaling $240 billion. That amount exceeds the total market value of Microsoft Corp., which reigned as the most influential company in personal computing until Apple ushered in an era of mobile devices with the 2007 release of the iPhone and the 2010 introduction of the iPad.

Cook, who became CEO shortly before Apple co-founder Steve Jobs died in October 2011, has a huge incentive to get the company's stock price strong again. The 1.1 million Apple shares he owns are worth about $300 million less than they were five months ago.

'I don't like it, either,' Cook said of the downturn in Apple's stock.

Apple Inc. hasn't unveiled another trailblazing product since Cook took over, raising concerns about whether the company is losing the ingenuity that has set it apart from the rest of the technology pack.

Cook told shareholders the company's commitment to innovation remains Apple's 'North Star' and 'the beat of its heart.'

His pep talk evidently didn't inspire many investors. Apple's stock shed another $4.40 to close Wednesday at $444.57.

Shareholders still affirmed their confidence in Cook at the meeting. Preliminary results showed Cook was re-elected to Apple's eight-member board of directors with 99 percent of the vote.

Wall Street may have been disappointed that Cook didn't provide any further clarity on whether Apple might distribute some of its $137 billion in cash to shareholders in the form of a dividend increase or a special one-time payment.

Apple shareholder David Einhorn, who runs the Greenlight Capital hedge fund, turned Apple's cash hoard into a hot topic in the weeks leading up the meeting. He sued to block a proposal that would have required shareholder approval for Apple to issue preferred stock. Einhorn argued that if approved, it would create a bureaucratic hurdle that could make it more cumbersome to return cash to shareholders. He wants Apple to issue preferred shares called 'iPrefs' that would yield an annual dividend of 4 percent.

A potential showdown was averted last week when a federal judge ruled that Apple had improperly bundled several corporate governance issues, including the handling of preferred stock, in the same proposal. Apple withdrew the proposal from Wednesday's agenda, to the chagrin of two shareholders who said they would have voted for it. Supporters of the measure included the California Public Employee Retirement System, or CalPERS, which urged Cook to do what's best for Apple's long-term interests.

'I would say the message is, 'Keep calm and carry on,'' said Anne Simpson, who oversees corporate governance for CalPERS.

Einhorn, whose fund owns 1.3 million Apple shares, didn't appear at Wednesday's meeting.

In response to a question Wednesday, Cook said Einhorn's resistance to a shareholder vote on preferred stock remains 'a silly sideshow, regardless of how a judge ruled on it.' Cook remarks echoed the derisive description he used during an appearance at an investor conference earlier this month.

Cook also sounded a familiar refrain when he discussed Apple's pile of cash. 'This is a serious subject, and one we deliberate on as a board and a management team. We are in very, very active discussions on it,' Cook said.

Not long after Cook made similar remarks at last year's annual meeting, Apple announced plans to start paying a quarterly dividend of $2.65 per share and to spend $10 billion buying back its stock in the fiscal year that began last October. Even though the dividend commitment costs Apple $10 billion annually, the company now has $39 billion more cash than it did year ago.

The prosperity underscores the ongoing popularity of Apple's products.

Although Apple is selling more gadgets than ever before, the company's profits and sales aren't growing as robustly because of fiercer competition from a multitude of other smartphones and tablet computers, including ones costing less. Apple's biggest headaches have been caused by Android, a mobile operating system that Internet search leader Google Inc. gives away to a long list of device makers led by Samsung Electronics Co.

There are now an estimated 600 million devices running on Android, giving it a lead over Apple.

Cook said Apple remains more interested in the quality of its products than the quantity sold.

'We want to make the best,' Cook said. 'That's why we are here.'

'The company is working as hard as ever, and we have some great stuff coming,' Cook told shareholders Wednesday before taking their questions during Apple's annual meeting at its Cupertino, Calif., headquarters.

True to Apple's secretive nature, Cook didn't provide any further product details, although at one point he said the company is considering entering other categories besides its popular line of digital music players, smartphones and tablet computers.

There has been speculation that Apple is working on an Internet-connected watch or TV that will be introduced later this year. One shareholder at Wednesday's meeting threw a new idea for Apple to ponder - a computerized bicycle. Cook, an avid bicyclist, chuckled at the suggestion, along with the rest of the audience.

Although there were more moments of levity, Wednesday's meeting was less celebratory than the events in past years, when Apple's stock price was soaring to the delight and enrichment of its shareholders.

Since hitting an all-time high of $705.07 five months ago, Apple's stock has plunged by 37 percent. The decline has wiped out collective shareholder wealth totaling $240 billion. That amount exceeds the total market value of Microsoft Corp., which reigned as the most influential company in personal computing until Apple ushered in an era of mobile devices with the 2007 release of the iPhone and the 2010 introduction of the iPad.

Cook, who became CEO shortly before Apple co-founder Steve Jobs died in October 2011, has a huge incentive to get the company's stock price strong again. The 1.1 million Apple shares he owns are worth about $300 million less than they were five months ago.

'I don't like it, either,' Cook said of the downturn in Apple's stock.

Apple Inc. hasn't unveiled another trailblazing product since Cook took over, raising concerns about whether the company is losing the ingenuity that has set it apart from the rest of the technology pack.

Cook told shareholders the company's commitment to innovation remains Apple's 'North Star' and 'the beat of its heart.'

His pep talk evidently didn't inspire many investors. Apple's stock shed another $4.40 to close Wednesday at $444.57.

Shareholders still affirmed their confidence in Cook at the meeting. Preliminary results showed Cook was re-elected to Apple's eight-member board of directors with 99 percent of the vote.

Wall Street may have been disappointed that Cook didn't provide any further clarity on whether Apple might distribute some of its $137 billion in cash to shareholders in the form of a dividend increase or a special one-time payment.

Apple shareholder David Einhorn, who runs the Greenlight Capital hedge fund, turned Apple's cash hoard into a hot topic in the weeks leading up the meeting. He sued to block a proposal that would have required shareholder approval for Apple to issue preferred stock. Einhorn argued that if approved, it would create a bureaucratic hurdle that could make it more cumbersome to return cash to shareholders. He wants Apple to issue preferred shares called 'iPrefs' that would yield an annual dividend of 4 percent.

A potential showdown was averted last week when a federal judge ruled that Apple had improperly bundled several corporate governance issues, including the handling of preferred stock, in the same proposal. Apple withdrew the proposal from Wednesday's agenda, to the chagrin of two shareholders who said they would have voted for it. Supporters of the measure included the California Public Employee Retirement System, or CalPERS, which urged Cook to do what's best for Apple's long-term interests.

'I would say the message is, 'Keep calm and carry on,'' said Anne Simpson, who oversees corporate governance for CalPERS.

Einhorn, whose fund owns 1.3 million Apple shares, didn't appear at Wednesday's meeting.

In response to a question Wednesday, Cook said Einhorn's resistance to a shareholder vote on preferred stock remains 'a silly sideshow, regardless of how a judge ruled on it.' Cook remarks echoed the derisive description he used during an appearance at an investor conference earlier this month.

Cook also sounded a familiar refrain when he discussed Apple's pile of cash. 'This is a serious subject, and one we deliberate on as a board and a management team. We are in very, very active discussions on it,' Cook said.

Not long after Cook made similar remarks at last year's annual meeting, Apple announced plans to start paying a quarterly dividend of $2.65 per share and to spend $10 billion buying back its stock in the fiscal year that began last October. Even though the dividend commitment costs Apple $10 billion annually, the company now has $39 billion more cash than it did year ago.

The prosperity underscores the ongoing popularity of Apple's products.

Although Apple is selling more gadgets than ever before, the company's profits and sales aren't growing as robustly because of fiercer competition from a multitude of other smartphones and tablet computers, including ones costing less. Apple's biggest headaches have been caused by Android, a mobile operating system that Internet search leader Google Inc. gives away to a long list of device makers led by Samsung Electronics Co.

There are now an estimated 600 million devices running on Android, giving it a lead over Apple.

Cook said Apple remains more interested in the quality of its products than the quantity sold.

'We want to make the best,' Cook said. 'That's why we are here.'

Apple CEO says he feels shareholders' pain, urges long view

CUPERTINO, California (Reuters) - Apple Inc CEO Tim Cook acknowledged on Wednesday that his shareholders were disappointed with a five-month slide of more than 30 percent in the company's share price, but urged a focus on the longer term.

The world's most valuable technology corporation headed into its annual meeting at its Cupertino headquarters on shakier ground than it has been accustomed to in years, since the iPhone and iPad helped elevate the company to premier investment status.

Its southward-heading share price has lent weight to Wall Street's demand that it share more of its $137 billion cash and securities pile, a debate now spearheaded by outspoken hedge fund manager David Einhorn.

Einhorn was not spotted at the meeting on Wednesday. Cook repeated that the company's board remained in 'very very active' discussions about options for cash sharing.

'I don't like it either. The board doesn't like it. The management team doesn't like it,' Cook told investors at the company's headquarters on 1 Infinite Loop.

But by focusing on the long term, revenue and profit will follow, he said.

Cook added that the company was working on new product categories, but, as usual, would not elaborate.

Speculation is rife on Wall Street and in Silicon Valley that the iPhone maker is working on a project to revolutionize the television and TV content, or a smart 'iWatch.'

Apple's stock was down 1.2 percent to $443.60 in early afternoon trade. It is now down more than 35 percent from its $702.10 September peak.

Despite a slip-sliding share price, dissatisfaction on the Street over its cash allocation strategy and uncertainty over its product pipeline, shareholders re-elected the entire board on Wednesday, and Cook won more than 99 percent of the vote in preliminary results.

(Reporting by Poornima Gupta; Editing by Lisa Von Ahn and Tim Dobbyn)

The world's most valuable technology corporation headed into its annual meeting at its Cupertino headquarters on shakier ground than it has been accustomed to in years, since the iPhone and iPad helped elevate the company to premier investment status.

Its southward-heading share price has lent weight to Wall Street's demand that it share more of its $137 billion cash and securities pile, a debate now spearheaded by outspoken hedge fund manager David Einhorn.

Einhorn was not spotted at the meeting on Wednesday. Cook repeated that the company's board remained in 'very very active' discussions about options for cash sharing.

'I don't like it either. The board doesn't like it. The management team doesn't like it,' Cook told investors at the company's headquarters on 1 Infinite Loop.

But by focusing on the long term, revenue and profit will follow, he said.

Cook added that the company was working on new product categories, but, as usual, would not elaborate.

Speculation is rife on Wall Street and in Silicon Valley that the iPhone maker is working on a project to revolutionize the television and TV content, or a smart 'iWatch.'

Apple's stock was down 1.2 percent to $443.60 in early afternoon trade. It is now down more than 35 percent from its $702.10 September peak.

Despite a slip-sliding share price, dissatisfaction on the Street over its cash allocation strategy and uncertainty over its product pipeline, shareholders re-elected the entire board on Wednesday, and Cook won more than 99 percent of the vote in preliminary results.

(Reporting by Poornima Gupta; Editing by Lisa Von Ahn and Tim Dobbyn)

Canadian government warns BBM PIN-to-PIN messaging is 'most vulnerable method of communicating on a BlackBerry'

Canadian government agency Public Safety Canada, which is tasked with overseeing cyber-security across all federal departments, has issued a memo warning government workers that communicating using BlackBerry Messenger PIN-to-PIN messaging is "the most vulnerable method of communicating on a BlackBerry." Canada's Postmedia News obtained the memo this week, which repeatedly advises workers to avoid sending PIN-to-PIN messages on their BlackBerry (BBRY) phones.

[More from BGR: Samsung picks Apple's pocket, ends up with Wallet [video]]

BlackBerry did not immediately have a statement available.

[More from BGR: Why every rival tech company should be scared to death of Samsung]

UPDATE: A BlackBerry spokesperson provided BGR with the following statement via email: "BlackBerry communications remain the most secure, preferred mobile communications used by governments worldwide. In fact, BlackBerry uniquely offers scalable, customizable security options for businesses and governments which allow them to apply their desired level of security."

According to the memo, PIN-to-PIN messages sent via BlackBerry Messenger could be intercepted and read by any BlackBerry user anywhere in the world. Because of this, the memo states that the service isn't "suitable for exchanging sensitive messages."

"Although PIN-to-PIN messages are encrypted, they key used is a global cryptographic 'key' that is common to every BlackBerry device all over the world," Public Safety Canada official stated in the memo. "Any BlackBerry device can potentially decrypt all PIN-to-PIN messages sent by any other BlackBerry device."

It should be noted that Public Safety Canada has failed to take into account the fact that organizations have the ability to change the encryption key to a unique one, ensuring that only BlackBerry devices using the same BES network can communicate with each other. There are also several ways to encode BBM messages such as S/MIME, which adds another layer of security.

This isn't a new position for the Canadian government, which has warned workers of PIN-to-PIN security issues for nearly a decade. The timing of this new warning couldn't be worse, however, as rival offerings from Apple (AAPL) and Google (GOOG) continue to gain momentum in enterprise and government environments.

Postmedia News states that nearly two-thirds of federal employees with government-issued mobile devices currently use BlackBerry phones.

This article was originally published on BGR.com

[More from BGR: Samsung picks Apple's pocket, ends up with Wallet [video]]

BlackBerry did not immediately have a statement available.

[More from BGR: Why every rival tech company should be scared to death of Samsung]

UPDATE: A BlackBerry spokesperson provided BGR with the following statement via email: "BlackBerry communications remain the most secure, preferred mobile communications used by governments worldwide. In fact, BlackBerry uniquely offers scalable, customizable security options for businesses and governments which allow them to apply their desired level of security."

According to the memo, PIN-to-PIN messages sent via BlackBerry Messenger could be intercepted and read by any BlackBerry user anywhere in the world. Because of this, the memo states that the service isn't "suitable for exchanging sensitive messages."

"Although PIN-to-PIN messages are encrypted, they key used is a global cryptographic 'key' that is common to every BlackBerry device all over the world," Public Safety Canada official stated in the memo. "Any BlackBerry device can potentially decrypt all PIN-to-PIN messages sent by any other BlackBerry device."

It should be noted that Public Safety Canada has failed to take into account the fact that organizations have the ability to change the encryption key to a unique one, ensuring that only BlackBerry devices using the same BES network can communicate with each other. There are also several ways to encode BBM messages such as S/MIME, which adds another layer of security.

This isn't a new position for the Canadian government, which has warned workers of PIN-to-PIN security issues for nearly a decade. The timing of this new warning couldn't be worse, however, as rival offerings from Apple (AAPL) and Google (GOOG) continue to gain momentum in enterprise and government environments.

Postmedia News states that nearly two-thirds of federal employees with government-issued mobile devices currently use BlackBerry phones.

This article was originally published on BGR.com

Tuesday, February 26, 2013

Apple outlook lowered on fear it cannot 'innovate' and 'disrupt' at pace set by Steve Jobs

Apple (AAPL) is expected to sit atop the consumer electronics industry for quite some time to come, but the company's stock continues to take a beating as growth inevitably slows and margins are squeezed. The latest ding to Apple shares came as Needam & Co. analyst Charlie Wolf lowered his price target from $750 to $710, citing a slowdown in iPhone sales growth and a crunch on iPad margins in the coming 12 months.

[More from BGR: Why every rival tech company should be scared to death of Samsung]

In explaining the logic behind his cut, Wolf writes that "the value of the iPad fell $11.83 or 10.8% to $98.11 chiefly because of the introduction of the iPad mini, which has a much lower gross margin that the full-sized iPad." Where smartphones are concerned, Wolf believes Apple's smartphones will have a less substantial impact on Apple shares than previously expected.

[More from BGR: Apple will reportedly announce stock split at tomorrow's shareholder meeting]

"The value of the iPhone fell $14.56 or 4.5% to $308.64 because of our assumption that the iPhone's worldwide share would stabilize at 20% rather than 22% as before," the analyst wrote in a note to clients picked up by Fortune.

"The lingering risk in the Apple story is that the company may no longer innovate at the same pace and with the same disruption that characterized the era when Steve Jobs was at the helm," Wolf wrote. "With respect to our valuation model, any deterioration in the iPhone's market share or gross margin would have an outsized impact on our price target."

This article was originally published on BGR.com

[More from BGR: Why every rival tech company should be scared to death of Samsung]

In explaining the logic behind his cut, Wolf writes that "the value of the iPad fell $11.83 or 10.8% to $98.11 chiefly because of the introduction of the iPad mini, which has a much lower gross margin that the full-sized iPad." Where smartphones are concerned, Wolf believes Apple's smartphones will have a less substantial impact on Apple shares than previously expected.

[More from BGR: Apple will reportedly announce stock split at tomorrow's shareholder meeting]

"The value of the iPhone fell $14.56 or 4.5% to $308.64 because of our assumption that the iPhone's worldwide share would stabilize at 20% rather than 22% as before," the analyst wrote in a note to clients picked up by Fortune.

"The lingering risk in the Apple story is that the company may no longer innovate at the same pace and with the same disruption that characterized the era when Steve Jobs was at the helm," Wolf wrote. "With respect to our valuation model, any deterioration in the iPhone's market share or gross margin would have an outsized impact on our price target."

This article was originally published on BGR.com

No word from Microsoft on Office for iPad

SEATTLE (Reuters) - A top Microsoft Corp executive side-stepped questions on Tuesday about any plans the software maker may have to bring its Office suite of applications to Apple Inc's iPad.

Talk has circulated for more than a year that Microsoft wants to bring native versions of its most profitable product to the hot-selling iPad, which one analyst estimates could generate $2.5 billion in extra revenue for Microsoft per year, but would remove an incentive to buying Windows-based tablets.

'We don't take it from the point of view, 'Do we need to have the PC software that's running on every single device?', we look very much at 'What is the experience that we are looking to have on those devices',' said Kurt DelBene, head of Microsoft's Office unit, asked about Office on the iPad at the Morgan Stanley technology investor conference in San Francisco, which was Webcast.

DelBene, who took over leadership of Office from Stephen Elop who left to lead phone maker Nokia in 2010, did not directly address putting native versions of Office applications on the iPad, a subject Microsoft has steered clear of in public.

Asked specifically about the availability of Office on Apple's iOS mobile system - which powers iPads and iPhones - DelBene instead stressed online versions of Office apps, which can be accessed via a browser but do not offer the full richness of installed software or an app.

'We've actually done a lot of work on iOS devices this time around,' said DelBene. 'We have enhanced the web applications pretty substantially, in partnership with Apple.'

Microsoft does offer native iOS versions of some Office applications, including its OneNote note-sharing software, Lync communication suite and SharePoint collaboration site, as well as its SkyDrive online storage service.

But the more than 100 million iPad owners, many of whom want to bring their devices to work, have to use the limited online versions of desktop staples Word, Excel and PowerPoint.

Morgan Stanley analyst Adam Holt estimated earlier this month that Microsoft could generate $2.5 billion in extra annual revenue from Office on iPad by next year, less the commission Apple would take on sales of Office through its App Store.

But the risk for Microsoft is that putting Office on the iPad takes away one of the key advantages of its own Surface and other Windows tablets, that already run Office natively.

Removing incentives to buy Windows tablets would be a blow to Microsoft's flagship Windows unit, which although less profitable than Office, is still key to the company's overall strategy.

Asked by one investor at the conference when he would be able to use Excel on his iPad, DelBene instead pointed the questioner toward Microsoft's own Surface RT and Surface Pro tablets and urged him to use Web-based versions of Office apps.

'I think we've done a great job on both the consumer side, particularly with the Web apps that we are building, and on the enterprise side as well,' said DelBene.

(Reporting By Bill Rigby; Editing by Bernard Orr)

Talk has circulated for more than a year that Microsoft wants to bring native versions of its most profitable product to the hot-selling iPad, which one analyst estimates could generate $2.5 billion in extra revenue for Microsoft per year, but would remove an incentive to buying Windows-based tablets.

'We don't take it from the point of view, 'Do we need to have the PC software that's running on every single device?', we look very much at 'What is the experience that we are looking to have on those devices',' said Kurt DelBene, head of Microsoft's Office unit, asked about Office on the iPad at the Morgan Stanley technology investor conference in San Francisco, which was Webcast.

DelBene, who took over leadership of Office from Stephen Elop who left to lead phone maker Nokia in 2010, did not directly address putting native versions of Office applications on the iPad, a subject Microsoft has steered clear of in public.

Asked specifically about the availability of Office on Apple's iOS mobile system - which powers iPads and iPhones - DelBene instead stressed online versions of Office apps, which can be accessed via a browser but do not offer the full richness of installed software or an app.

'We've actually done a lot of work on iOS devices this time around,' said DelBene. 'We have enhanced the web applications pretty substantially, in partnership with Apple.'

Microsoft does offer native iOS versions of some Office applications, including its OneNote note-sharing software, Lync communication suite and SharePoint collaboration site, as well as its SkyDrive online storage service.

But the more than 100 million iPad owners, many of whom want to bring their devices to work, have to use the limited online versions of desktop staples Word, Excel and PowerPoint.

Morgan Stanley analyst Adam Holt estimated earlier this month that Microsoft could generate $2.5 billion in extra annual revenue from Office on iPad by next year, less the commission Apple would take on sales of Office through its App Store.

But the risk for Microsoft is that putting Office on the iPad takes away one of the key advantages of its own Surface and other Windows tablets, that already run Office natively.

Removing incentives to buy Windows tablets would be a blow to Microsoft's flagship Windows unit, which although less profitable than Office, is still key to the company's overall strategy.

Asked by one investor at the conference when he would be able to use Excel on his iPad, DelBene instead pointed the questioner toward Microsoft's own Surface RT and Surface Pro tablets and urged him to use Web-based versions of Office apps.

'I think we've done a great job on both the consumer side, particularly with the Web apps that we are building, and on the enterprise side as well,' said DelBene.

(Reporting By Bill Rigby; Editing by Bernard Orr)

Asus Fonepad preview: Decent tablet, terrible phone

Why? Seriously, Asus (2357). Why? This question bears asking, as going hands-on with Asus' new Fonepad truly requires some big hands. Single-handed operation is a thing of the past. Remember when diminutive phones were the latest trend? When iPod grew smaller and smaller and RAZRs got thinner and thinner? Wave goodbye, dear friends. That age is long gone.

[More from BGR: Why every rival tech company should be scared to death of Samsung]

To be fair, the Fonepad is a great tablet. For $249, you get a full-featured and powerful 7-inch device with a 1.2GHz Atom Z2420 processor, 1GB RAM, 8GB of onboard storage (with models sporting up to 32GB available), a front-facing 1.2-megapixel camera and a 3-megapixel rear camera. In practice, operation is seamless and smooth. No complaints in the performance department, though the 7-inch WXGA display does leave a bit to be desired.

[More from BGR: LG says it's done fighting the 'specs war,' will focus on crafting novel smartphone features]

That Asus can design and bring to market a high-quality affordable tablet is a foregone conclusion. We already have, and love, the Nexus 7. Why, then, would the company move to introduce another device so similar to its popular Google-branded Nexus?

The Fonepad is the answer to a question no-one asked: What would happen if you turned a Nexus 7 into a phone?

The hallmark feature here is that the Fonepad allows the user to make calls. Never mind that holding this thing up to your ear runs the risk of blocking out any/all ambient light in the room, never mind that the microphone lays approximately 7-inches below the speaker, and nevermind that we can't think of a single living, breathing human who would ever consider replacing his or her existing mobile phone with something of this size. The Fonepad is a phone, and ASUS expects you to use it as such.

In a world where companies like Samsung (005930) and Nokia (NOK) are (over)using the word "human" to described their design language, Asus (and Samsung with its Galaxy Note 8.0, but that's another story entirely) has opted for a decidedly inhuman approach to its newest device.

The Fonepad is not a bad tablet. As a matter of fact, for $249, it's a pretty decent tablet, ignoring for a moment, if you can, the fact that a nearly identical Nexus 7 can be had for $199. The problem is, it's a terrible phone.

This article was originally published on BGR.com

[More from BGR: Why every rival tech company should be scared to death of Samsung]

To be fair, the Fonepad is a great tablet. For $249, you get a full-featured and powerful 7-inch device with a 1.2GHz Atom Z2420 processor, 1GB RAM, 8GB of onboard storage (with models sporting up to 32GB available), a front-facing 1.2-megapixel camera and a 3-megapixel rear camera. In practice, operation is seamless and smooth. No complaints in the performance department, though the 7-inch WXGA display does leave a bit to be desired.

[More from BGR: LG says it's done fighting the 'specs war,' will focus on crafting novel smartphone features]

That Asus can design and bring to market a high-quality affordable tablet is a foregone conclusion. We already have, and love, the Nexus 7. Why, then, would the company move to introduce another device so similar to its popular Google-branded Nexus?

The Fonepad is the answer to a question no-one asked: What would happen if you turned a Nexus 7 into a phone?

The hallmark feature here is that the Fonepad allows the user to make calls. Never mind that holding this thing up to your ear runs the risk of blocking out any/all ambient light in the room, never mind that the microphone lays approximately 7-inches below the speaker, and nevermind that we can't think of a single living, breathing human who would ever consider replacing his or her existing mobile phone with something of this size. The Fonepad is a phone, and ASUS expects you to use it as such.

In a world where companies like Samsung (005930) and Nokia (NOK) are (over)using the word "human" to described their design language, Asus (and Samsung with its Galaxy Note 8.0, but that's another story entirely) has opted for a decidedly inhuman approach to its newest device.

The Fonepad is not a bad tablet. As a matter of fact, for $249, it's a pretty decent tablet, ignoring for a moment, if you can, the fact that a nearly identical Nexus 7 can be had for $199. The problem is, it's a terrible phone.

This article was originally published on BGR.com

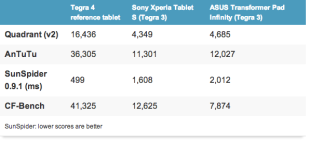

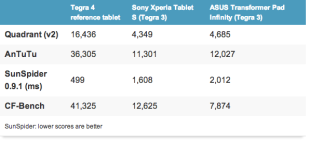

Tegra 4 performance crushes current-gen processors

NVIDIA's (NVDA) next-generation processors won't be available in devices until later this year, however early benchmarks have revealed that the new chipset will be worth the wait. Engadget ran a variety of benchmark tests on one of the company's Tegra 4 reference tablets and was left with scores that in some cases nearly quadrupled the performance of older Tegra 3 devices.

[More from BGR: Samsung is just trolling us now, and it's not alone]

[More from BGR: Another major security flaw discovered on iPhone [video]]

Tegra 4 Quadrant scores topped out at 16,436 and AnTuTu benchmarks reached over 36,000, both of which more than tripled the performance from comparable Tegra 3 tablets. Perhaps the most impressive result was the 499ms score from the SunSpider test. The Tegra 4 benchmark, which measures web browsing performance, nearly halved Apple's iPad 4 score of 865ms.

NVIDIA and its partners are scheduled to debut Tegra 4 in smartphones, tablets and the company's Project Shield gaming device in July.

This article was originally published on BGR.com

[More from BGR: Samsung is just trolling us now, and it's not alone]

[More from BGR: Another major security flaw discovered on iPhone [video]]

Tegra 4 Quadrant scores topped out at 16,436 and AnTuTu benchmarks reached over 36,000, both of which more than tripled the performance from comparable Tegra 3 tablets. Perhaps the most impressive result was the 499ms score from the SunSpider test. The Tegra 4 benchmark, which measures web browsing performance, nearly halved Apple's iPad 4 score of 865ms.

NVIDIA and its partners are scheduled to debut Tegra 4 in smartphones, tablets and the company's Project Shield gaming device in July.

This article was originally published on BGR.com

Monday, February 25, 2013

Purported fifth-gen iPad cases reveal new iPad mini-inspired design

A number of reports have suggested that Apple (AAPL) plans to redesign its fifth-generation iPad to resemble the smaller iPad mini. Purported images of the next-generation tablet surfaced last month that seemingly confirmed the company's plans, and now additional images of iPad 5 cases were discovered on Chinese e-commerce site Alibaba that further support rumors of the tablet's upcoming redesign. Third-party case makers sometimes have reliable supply chain sources that feed them information and allow them to get a jump on the competition with cases for unreleased and unannounced products. While this is no guarantee that the designs pictured are accurate, it's one more piece of a puzzle that points to a major overhaul for the fifth-generation iPad. Images of the cases follow below.

[More from BGR: Samsung is just trolling us now, and it's not alone]

[More from BGR: BlackBerry Z10 outselling iPhone 5, Galaxy S III at major Canadian retailer]

This article was originally published on BGR.com

[More from BGR: Samsung is just trolling us now, and it's not alone]

[More from BGR: BlackBerry Z10 outselling iPhone 5, Galaxy S III at major Canadian retailer]

This article was originally published on BGR.com

BlackBerry Z10 outselling iPhone 5, Galaxy S III at major Canadian retailer

Following a string of analyst downgrades - and a note from MKM Partners suggesting there's a 90% chance BlackBerry 10 flops - BlackBerry (BBRY) got a boost Monday on news that its new BlackBerry Z10 smartphone is outselling Apple's (AAPL) iPhone 5 and Samsung's (005930) flagship Galaxy S III at a major Canadian retailer. Glentel on Monday said in a statement that since the BlackBerry Z10 launched on February 5th, it has been "the leading smartphone" sold through retailer's stores, The Globe and Mail reports. The company owns 330 retail outlets across Canada.

[More from BGR: Samsung is just trolling us now, and it's not alone]

Recent reports suggested that the BlackBerry Z10 sold out at a number of retailers around Canada and the U.K., however several industry watchers claimed the stock-outs were the result of limited supply. While Glentel declined to share actual sales figures in its statement, the fact that the Z10 has outsold the two most popular smartphones in the world over the past three weeks suggests solid performance for BlackBerry's first BB10 smartphone.

[More from BGR: Firm says 90% chance BlackBerry 10 flops]

BlackBerry shares were trading up nearly 2% on Monday afternoon.

This article was originally published on BGR.com

[More from BGR: Samsung is just trolling us now, and it's not alone]

Recent reports suggested that the BlackBerry Z10 sold out at a number of retailers around Canada and the U.K., however several industry watchers claimed the stock-outs were the result of limited supply. While Glentel declined to share actual sales figures in its statement, the fact that the Z10 has outsold the two most popular smartphones in the world over the past three weeks suggests solid performance for BlackBerry's first BB10 smartphone.

[More from BGR: Firm says 90% chance BlackBerry 10 flops]

BlackBerry shares were trading up nearly 2% on Monday afternoon.

This article was originally published on BGR.com

HP Slate 7 preview: HP's return to tablets is better than expected

My first reaction when I learned HP (HPQ) was going to build an Android tablet was, "Dear God, why?" But after playing around with the tablet a bit and seeing its super-low price point, I've concluded that HP's new Slate 7 is actually a pretty solid effort for the company's foray back into the tablet world. Let's start with the price because it's the most obviously appealing part of the tablet at a rock-bottom $169. What makes this clever on HP's part is that it can offer the cheap tablet as almost a throw-in to its PC customers who would be interested in owning it as a complement their new computers. So not only is HP undercutting the Kindle Fire and the Nexus 7 price-wise, but it's also creating an opportunity to package its tablet to its existing customers as a nice add-on.

[More from BGR: Samsung is just trolling us now, and it's not alone]

So OK, we know the price is nice but what about the tablet itself? While the Slate doesn't measure up well against the best Android tablets or the iPad mini, it does show some promise for a first-time entry into the market. I found that the Slate 7 had a solid build and that its compact size that felt snug in your hands. Unlike Sony (SNE), HP seems to understand that making a tablet enjoyable to hold goes beyond simply making it feel light - having rounded edges and a soft-touch texture on the back panel make it vastly better from a practical standpoint than Sony's boxy and awkward Xperia Tablet Z.

[More from BGR: Firm says 90% chance BlackBerry 10 flops]

On the downside, the Slate 7's display is not at all good compared to the Kindle Fire and the Nexus 7, with a resolution of just 1,024 x 600 pixels that really does look dull compared to what we've come to expect from smaller tablets. Additionally, the Slate 7 runs on a a dual-core 1.6GGHz ARM Cortex-A9 processor that is a demonstrably inferior piece of hardware than the quad-core Tegra 3 processor used by the Nexus 7.

All the same, I wasn't expecting to be blown away by HP's first attempt at making a tablet since its ill-fated TouchPad project imploded, so I consider the Slate 7 a solid first attempt by HP to dip its toes into the cheap Android tablet market. Whether the company is at all successful in selling budget Android tablets depends on whether it uses this foundation to build something better in the future.

This article was originally published on BGR.com

[More from BGR: Samsung is just trolling us now, and it's not alone]

So OK, we know the price is nice but what about the tablet itself? While the Slate doesn't measure up well against the best Android tablets or the iPad mini, it does show some promise for a first-time entry into the market. I found that the Slate 7 had a solid build and that its compact size that felt snug in your hands. Unlike Sony (SNE), HP seems to understand that making a tablet enjoyable to hold goes beyond simply making it feel light - having rounded edges and a soft-touch texture on the back panel make it vastly better from a practical standpoint than Sony's boxy and awkward Xperia Tablet Z.

[More from BGR: Firm says 90% chance BlackBerry 10 flops]

On the downside, the Slate 7's display is not at all good compared to the Kindle Fire and the Nexus 7, with a resolution of just 1,024 x 600 pixels that really does look dull compared to what we've come to expect from smaller tablets. Additionally, the Slate 7 runs on a a dual-core 1.6GGHz ARM Cortex-A9 processor that is a demonstrably inferior piece of hardware than the quad-core Tegra 3 processor used by the Nexus 7.

All the same, I wasn't expecting to be blown away by HP's first attempt at making a tablet since its ill-fated TouchPad project imploded, so I consider the Slate 7 a solid first attempt by HP to dip its toes into the cheap Android tablet market. Whether the company is at all successful in selling budget Android tablets depends on whether it uses this foundation to build something better in the future.

This article was originally published on BGR.com

Firm says 90% chance BlackBerry 10 flops

Industry watchers are still mixed on whether or not BlackBerry (BBRY) can pull off the incredible comeback it is currently attempting. Some big firms are seeing signs of life while others maintain their position that BlackBerry is a sinking ship. Count Connecticut-based equity research firm MKM Partners in the latter category. In a recent note to clients, MKM analyst Michael Genovese cut his outlook on BlackBerry shares and said there is now a 90% BlackBerry 10 will flop.

[More from BGR: Did Barnes & Noble just kill off Nook?]

"We have been testing the Z10 and like the operating system, especially the touchscreen BB10 keyboard predictive text functionality, but we do not think it is differentiated enough to save the brand," Genovese wrote. "The Z10 hardware seems bulky and heavy, but the biggest problem by far is the lack of available applications for BB10."

[More from BGR: Samsung confirms Galaxy S IV will debut on March 14th]

The analyst says that based on his digging, fewer than 10% of the top-100 Android apps and fewer than 5% of the most popular iPhone apps are available on BlackBerry's new platform. "Not a single top-50-grossing app on Android or the iPhone can be acquired for the Z10," Genovese noted.

MKM cut its rating on BlackBerry shares from Neutral to Sell with a $10 price target, down from $12.

"Our new price target reflects the lower probability of success we attribute to BlackBerry 10 following our testing of the Z10 and observing BB10's momentum stall out in the U.K. after only a few weeks," Genovese wrote. "We reduce the estimated probability that BB10 will be a success and the stock will appreciate to $40 to 10% from 15% and increase the estimated probability that BB10 will fail and the stock will decline to $7 to 90% from 85%."

MKM now sees February-quarter BlackBerry Z10 channel sales totaling 400,000 units, down from its earlier estimate of 1.5 million.

This article was originally published on BGR.com

[More from BGR: Did Barnes & Noble just kill off Nook?]

"We have been testing the Z10 and like the operating system, especially the touchscreen BB10 keyboard predictive text functionality, but we do not think it is differentiated enough to save the brand," Genovese wrote. "The Z10 hardware seems bulky and heavy, but the biggest problem by far is the lack of available applications for BB10."

[More from BGR: Samsung confirms Galaxy S IV will debut on March 14th]

The analyst says that based on his digging, fewer than 10% of the top-100 Android apps and fewer than 5% of the most popular iPhone apps are available on BlackBerry's new platform. "Not a single top-50-grossing app on Android or the iPhone can be acquired for the Z10," Genovese noted.

MKM cut its rating on BlackBerry shares from Neutral to Sell with a $10 price target, down from $12.

"Our new price target reflects the lower probability of success we attribute to BlackBerry 10 following our testing of the Z10 and observing BB10's momentum stall out in the U.K. after only a few weeks," Genovese wrote. "We reduce the estimated probability that BB10 will be a success and the stock will appreciate to $40 to 10% from 15% and increase the estimated probability that BB10 will fail and the stock will decline to $7 to 90% from 85%."

MKM now sees February-quarter BlackBerry Z10 channel sales totaling 400,000 units, down from its earlier estimate of 1.5 million.

This article was originally published on BGR.com

TSX may open higher, investors eye Italian elections

(Reuters) - Canadian stocks looked set to open higher on Monday, tracking global markets, helped by speculation that the United States and Japan will offer ultra easy monetary policy for some time, but uncertainty about the outcome of the closely-fought election in Italy could keep a lid on gains.

TOP STORIES

* Sales of BlackBerry's make-or-break line of smartphones are running faster than expected, and the company has increased production too keep up, its chief executive said in a newspaper.

* Suncor Energy Inc and Canadian Natural Resources Ltd : Shares of the two companies could gain more than 25 percent in the next year, helped by valuable asset bases that may attract activist investors, Barron's said in its February 25 edition.

* Italians voted for a second and final day in a general election on Monday with a surge in protest votes increasing the risk of an unstable outcome that could undermine Europe's efforts to end its three-year debt crisis.

* Japan's prime minister is likely to nominate an advocate of aggressive monetary easing - Asian Development Bank President Haruhiko Kuroda - as the next central bank governor to step up his fight to finally rid the country of deflation.

* China Petroleum & Chemical Corp (Sinopec), Asia's largest oil refiner, will buy a 50 percent stake in Chesapeake Energy Corp's Mississippi Lime oil and gas properties in Oklahoma and Kansas for $1.02 billion, a Sinopec source said.

(Reporting by Chandrashekhar Modi; Editing by Jeffrey Hodgson)

TOP STORIES

* Sales of BlackBerry's

* Suncor Energy Inc

* Italians voted for a second and final day in a general election on Monday with a surge in protest votes increasing the risk of an unstable outcome that could undermine Europe's efforts to end its three-year debt crisis.

* Japan's prime minister is likely to nominate an advocate of aggressive monetary easing - Asian Development Bank President Haruhiko Kuroda - as the next central bank governor to step up his fight to finally rid the country of deflation.

* China Petroleum & Chemical Corp (Sinopec), Asia's largest oil refiner, will buy a 50 percent stake in Chesapeake Energy Corp's Mississippi Lime oil and gas properties in Oklahoma and Kansas for $1.02 billion, a Sinopec source said.

(Reporting by Chandrashekhar Modi; Editing by Jeffrey Hodgson)

Sunday, February 24, 2013

Apple signals emerging-market rethink with India push

NEW DELHI/BANGALORE (Reuters) - As BlackBerry launches the first smartphone from its make-or-break BB10 line in India, one of its most loyal markets, the company faces new competition from a formidable rival that has long had a minimal presence in the country.

More than four years after it started selling iPhones in India, Apple Inc is now aggressively pushing the iconic device through installment payment plans that make it more affordable, a new distribution model and heavy marketing blitz.

'Now your dream phone' at 5,056 rupees ($93), read a recent full front-page ad for an iPhone 5 in the Times of India, referring to the initial payment on a phone priced at $840, or almost two months' wages for an entry-level software engineer.

The new-found interest in India suggests a subtle strategy shift for Apple, which has moved tentatively in emerging markets and has allowed rivals such as Samsung and Blackberry to dominate with more affordable smartphones. With the exception of China, all of its Apple stores are in advanced economies.

Apple expanded its India sales effort in the latter half of 2012 by adding two distributors. Previously it sold iPhones only through a few carriers and stores it calls premium resellers.

The result: iPhone shipments to India between October and December nearly tripled to 250,000 units from 90,000 in the previous quarter, according to an estimate by Jessica Kwee, a Singapore-based analyst at consultancy Canalys.

At The MobileStore, an Indian chain owned by the Essar conglomerate, which says it sells 15 percent of iPhones in the country, iPhone sales tripled between December and January, thanks to a monthly payment scheme launched last month.

'Most people in India can't afford a dollar-priced phone when the salaries in India are rupee salaries. But the desire is the same,' said Himanshu Chakrawarti, its chief executive.

Apple, the distributors, retailers and banks share the advertising and interest cost of the marketing push, according to Chakrawarti. Carriers like Bharti Airtel Ltd, which also sell the iPhone 5, run separate ads.

India is the world's No. 2 cellphone market by users, but most Indians can't afford fancy handsets. Smartphones account for just a tenth of total phone sales. In India, 95 percent of cellphone users have prepaid accounts without a fixed contract. Unlike in the United States, carriers do not subsidize handsets.

Within the smartphone segment, Apple's Indian market share last quarter was just 5 percent, according to Canalys, meaning its overall penetration is tiny.

Still, industry research firm IDC expects the Indian smartphone market to grow more than five times from about 19 million units last year to 108 million in 2016, which presents a big opportunity.

Samsung Electronics dominates Indian smartphone sales with a 40 percent share, thanks to its wide portfolio of Android devices priced as low as $110. The market has also been flooded by cheaper Android phones from local brands such as Micromax and Lava.

Most smartphones sold in India are much cheaper than the iPhone, said Gartner analyst Anshul Gupta.

'Where the masses are - there, Apple still has a gap.'

'I LOVE INDIA, BUT...'

Apple helped create the smartphone industry with the iPhone in 2007, but last year lost its lead globally to Samsung whose free Android software is especially attractive in Asia.

Many in Silicon Valley and Wall Street believe the surest way to penetrate lower-income Asian markets would be with a cheaper iPhone, as has been widely reported but never confirmed. The risk is that a cheap iPhone would cannibalize demand for the premium version and eat into Apple's peerless margins.

The new monthly payment plan in India goes a long way to expanding the potential market, said Chakrawarti.

'The Apple campaign is not meant for really the regular top-end customer, it is meant to upgrade the 10,000-12,000 handset guy to 45,000 rupees,' he said.

Apple's main focus for expansion in Asia has been Greater China, including Taiwan and Hong Kong, where revenue grew 60 percent last quarter to $7.3 billion.

Asked last year why Apple had not been as successful in India, Chief Executive Tim Cook said its business in India was growing but the group remained more focused on other markets.

'I love India, but I believe that Apple has some higher potential in the intermediate term in some other countries,' Cook said. 'The multi-layer distribution there really adds to the cost of getting products to market,' he said at the time.

Apple, which has partly addressed that by adding distributors, did not respond to an email seeking comment.

Ingram Micro Inc, one of its new distributors, also declined comment. Executives at Redington (India) Ltd, the other distributor, could not immediately be reached.

BlackBerry, which has seen its global market share shrivel to 3.4 percent from 20 percent over the past three years, is making what is seen as a last-ditch effort to save itself with the BB10 series.

The high-end BlackBerry Z10 to be launched in India on Monday is expected to be priced not far from the 45,500 rupees price tag for an iPhone 5 with 16 gigabytes of memory. Samsung's Galaxy S3 and Galaxy Note 2, Nokia's Lumia 920 and two HTC Corp models are the main iPhone rivals.

Until last year, Blackberry was the No. 3 smartphone brand in India with market share of more than 10 percent, thanks to a push into the consumer segment with lower-priced phones. Last quarter its share fell to about 5 percent, putting it in fifth place, according to Canalys. Apple was sixth.

($1 = 54.2000 Indian rupees)

(Additional reporting by Aradhana Aravindan in MUMBAI and Poornima Gupta in SAN FRANCISCO; Editing by Tony Munroe and Mark Bendeich)

More than four years after it started selling iPhones in India, Apple Inc is now aggressively pushing the iconic device through installment payment plans that make it more affordable, a new distribution model and heavy marketing blitz.

'Now your dream phone' at 5,056 rupees ($93), read a recent full front-page ad for an iPhone 5 in the Times of India, referring to the initial payment on a phone priced at $840, or almost two months' wages for an entry-level software engineer.

The new-found interest in India suggests a subtle strategy shift for Apple, which has moved tentatively in emerging markets and has allowed rivals such as Samsung and Blackberry to dominate with more affordable smartphones. With the exception of China, all of its Apple stores are in advanced economies.

Apple expanded its India sales effort in the latter half of 2012 by adding two distributors. Previously it sold iPhones only through a few carriers and stores it calls premium resellers.

The result: iPhone shipments to India between October and December nearly tripled to 250,000 units from 90,000 in the previous quarter, according to an estimate by Jessica Kwee, a Singapore-based analyst at consultancy Canalys.

At The MobileStore, an Indian chain owned by the Essar conglomerate, which says it sells 15 percent of iPhones in the country, iPhone sales tripled between December and January, thanks to a monthly payment scheme launched last month.

'Most people in India can't afford a dollar-priced phone when the salaries in India are rupee salaries. But the desire is the same,' said Himanshu Chakrawarti, its chief executive.

Apple, the distributors, retailers and banks share the advertising and interest cost of the marketing push, according to Chakrawarti. Carriers like Bharti Airtel Ltd, which also sell the iPhone 5, run separate ads.

India is the world's No. 2 cellphone market by users, but most Indians can't afford fancy handsets. Smartphones account for just a tenth of total phone sales. In India, 95 percent of cellphone users have prepaid accounts without a fixed contract. Unlike in the United States, carriers do not subsidize handsets.

Within the smartphone segment, Apple's Indian market share last quarter was just 5 percent, according to Canalys, meaning its overall penetration is tiny.

Still, industry research firm IDC expects the Indian smartphone market to grow more than five times from about 19 million units last year to 108 million in 2016, which presents a big opportunity.

Samsung Electronics dominates Indian smartphone sales with a 40 percent share, thanks to its wide portfolio of Android devices priced as low as $110. The market has also been flooded by cheaper Android phones from local brands such as Micromax and Lava.

Most smartphones sold in India are much cheaper than the iPhone, said Gartner analyst Anshul Gupta.

'Where the masses are - there, Apple still has a gap.'

'I LOVE INDIA, BUT...'

Apple helped create the smartphone industry with the iPhone in 2007, but last year lost its lead globally to Samsung whose free Android software is especially attractive in Asia.

Many in Silicon Valley and Wall Street believe the surest way to penetrate lower-income Asian markets would be with a cheaper iPhone, as has been widely reported but never confirmed. The risk is that a cheap iPhone would cannibalize demand for the premium version and eat into Apple's peerless margins.

The new monthly payment plan in India goes a long way to expanding the potential market, said Chakrawarti.

'The Apple campaign is not meant for really the regular top-end customer, it is meant to upgrade the 10,000-12,000 handset guy to 45,000 rupees,' he said.

Apple's main focus for expansion in Asia has been Greater China, including Taiwan and Hong Kong, where revenue grew 60 percent last quarter to $7.3 billion.

Asked last year why Apple had not been as successful in India, Chief Executive Tim Cook said its business in India was growing but the group remained more focused on other markets.

'I love India, but I believe that Apple has some higher potential in the intermediate term in some other countries,' Cook said. 'The multi-layer distribution there really adds to the cost of getting products to market,' he said at the time.

Apple, which has partly addressed that by adding distributors, did not respond to an email seeking comment.

Ingram Micro Inc, one of its new distributors, also declined comment. Executives at Redington (India) Ltd, the other distributor, could not immediately be reached.

BlackBerry, which has seen its global market share shrivel to 3.4 percent from 20 percent over the past three years, is making what is seen as a last-ditch effort to save itself with the BB10 series.

The high-end BlackBerry Z10 to be launched in India on Monday is expected to be priced not far from the 45,500 rupees price tag for an iPhone 5 with 16 gigabytes of memory. Samsung's Galaxy S3 and Galaxy Note 2, Nokia's Lumia 920 and two HTC Corp models are the main iPhone rivals.

Until last year, Blackberry was the No. 3 smartphone brand in India with market share of more than 10 percent, thanks to a push into the consumer segment with lower-priced phones. Last quarter its share fell to about 5 percent, putting it in fifth place, according to Canalys. Apple was sixth.

($1 = 54.2000 Indian rupees)

(Additional reporting by Aradhana Aravindan in MUMBAI and Poornima Gupta in SAN FRANCISCO; Editing by Tony Munroe and Mark Bendeich)

Samsung takes on iPad Mini with Galaxy Note 8.0

BARCELONA, Spain (AP) -- Samsung Electronics is beefing up its tablet range with a competitor to Apple's iPad Mini that sports a pen for writing on the screen.

The Korean company announced on Sunday in B'arcelona that the Galaxy Note 8.0 will have an 8-inch screen, putting it very close in size to the Apple's tablet, which launched in November with a 7.9-inch screen. It's not the first time Samsung has made a tablet that's in the Mini's size range: it's very first iPad competitor had a 7-inch screen, and it still makes a tablet of that size, but without a pen.

Samsung will start selling the new tablet in the April to June period, at an as yet undetermined price. It made the announcement ahead of Mobile World Congress, the wireless industry's annual trade show, which starts Monday in Barcelona, Spain.

The Note 8.0 fills a gap in Samsung's line-up of pen-equipped devices between the Galaxy Note II smartphone, with its 5.5-inch screen, and the Galaxy Note 10.1, a full-size tablet. Samsung has made the pen, or more properly the stylus, one of the tools it uses to chip away at Apple's dominance in both tablets and high-end smartphones. Apple doesn't make any devices that work with styluses, preferring to optimize its interfaces for fingers, mice and touchpads.

On Samsung's Note line, the pens can be used to write, highlight and draw. The screens also sense when the mouse hovers over the screen, providing an equivalent to the hovering mouse cursor on the PC. However, few third-party applications have been modified to take full advantage of the pens.

Saturday, February 23, 2013

Big studios behind swag-fueled Oscar push

LOS ANGELES (AP) - Giant coffee table books, iPod Shuffles, signed letters from directors, even 'Lincoln' turkey roasting pans. That's just some of the largesse doled out by the studios to voters for awards presented earlier this season - each with the potential to influence the outcome of Hollywood's most important awards, Sunday night's Oscars.

Such gifts are strictly forbidden by the Academy of Motion Picture Arts and Sciences. But for studios, the stakes are high, and they've been creative in working around the rules to give their movies the best spotlight possible. A best picture win can boost a film's commercial appeal and solidify relations with big-name actors and directors.

This year, top Oscar contenders 'Argo' from Warner Bros. and 'Lincoln' from Disney pitted two deep-pocketed rivals against each other in what some say was an unprecedented level of Oscar campaigning. There was even some targeted sniping about the films' bending of historical facts.

Part of what's behind the seemingly unrestrained lobbying is that this year, an unusually large number of best picture nominees are also doing well at the box office, giving the studios dry powder for their campaigns.

Six of the nine contenders for the top Oscar have reaped $100 million or more in ticket sales domestically, and collectively they've earned $309 million since the nominations Jan. 10, according to Hollywood.com. This record-setting 'Oscar bump' dwarfs the $111 million the nine best picture nominees made between the nominations and the awards ceremony last year. It also trumps the season that 2009's megahit 'Avatar' was in the running, when 10 nominees brought in $204 million in bump.

That means there's plenty of reason for studios to keep spending - even to the extent of papering the walls of the popular Beverly Hills restaurant Kate Mantilini with campaign posters, which conveniently tower over diners just a block from the motion picture academy itself.

'I have never seen such an assault in terms of stuff being sent to us,' said Pete Hammond, a member of the Broadcast Film Critics Association, which hosts the Critics Choice Awards, and a columnist for the Hollywood blog Deadline.com.

Hammond is one of several voters for the earlier awards where wins translate into momentum for Oscar hopefuls. They say their mailboxes were swamped with swag this year - all of it an attempt to reach the 5,800 academy members who vote on the Oscars, albeit through indirect means.

From the campaign of Steven Spielberg's 'Lincoln,' members of the broadcast critics group say they received no less than four coffee table books, an intricately framed DVD for review purposes and even a hand-signed letter from Spielberg himself, thanking them for recognizing the film with so many nominations. Some awards voters also received 'Lincoln' turkey roasting pans, according to an industry insider who spoke on the condition of anonymity because the person was not authorized to speak publicly about the matter.

The broadcast critics also received an iPod Shuffle, which retails for $49, containing the soundtrack to Universal Pictures' 'Les Miserables,' which is up for music and sound mixing awards.

Several voters said this level of giveaway was unusual, but then again, in recent times, well-funded major studios haven't been that involved.

In the last two years, the movie industry's top honor went to The Weinstein Co.'s 'The Artist' and 'The King's Speech.' Previous to that, 2009's winner was 'The Hurt Locker,' whose backer Summit Entertainment was just starting to get its 'Twilight' mojo and was yet to be flush with cash.

Before that it was Fox Searchlight's 'Slumdog Millionaire' and before that 'No Country for Old Men' by Paramount Vantage - both smaller arms of major studios that have smaller marketing budgets than their larger siblings.

This year, the majors are back in the game in a big way. In addition to Warner's 'Argo' and Disney's 'Lincoln,' Sony Pictures is behind 'Zero Dark Thirty,' 20th Century Fox is backing 'Life of Pi' and Universal is the force behind 'Les Miserables.'

While The Weinstein Co.'s 'Silver Linings Playbook' is earning boffo business above $100 million in ticket sales following co-chairman Harvey Weinstein's familiar script of making the most of awards season, it appears that this year, the majors have studied up.

'Nobody ever did it besides Harvey, and now everybody's done it this year,' said David Poland of MovieCityNews.com, which means more intense campaigning because there's more money to spend.

One look at the release pattern of 'Zero Dark Thirty' and it's clear that Sony didn't want to repeat what happened to 'The Hurt Locker,' another Katherine Bigelow-directed war film that despite its best picture win, made just $19 million in theaters worldwide. Part of the problem with 'Hurt' was that it came out in June and was all but gone from theaters by the time the Oscar nominations rolled around.

Instead, 'ZDT' showed in just a handful of theaters in December to qualify for the 2012 Oscars, but burst onto 3,000 theaters the day after the nominations in January, capturing the top spot at the box office that weekend.

'We designed our release campaign to take advantage of key dates in the awards season,' said Sony Pictures spokesman Steve Elzer. 'With approximately $90 million in box office to date, the film has been a huge critical and commercial success and no matter how we do at the Oscar ceremony on Sunday, we couldn't be more pleased with the film's performance.'

Starting small and then going wide after the nominations is the 'Playbook' that The Weinstein Co. has followed for years, although company co-chairman Harvey Weinstein denies the pattern.

'There is no playbook, there is no campaigning,' Weinstein said. 'I have always said the most important thing is to get people to see the films and everything else is mostly fluff.'

Even films at the tail end of their box-office run are pumping up the volume. 'Argo,' which came out in October, was heavily advertised by Warner Bros. ahead of the DVD release this Tuesday. The studio began selling digital downloads two weeks ahead of that. Fox followed a similar strategy for 'Life of Pi.'

'Because these films are so strong, all the companies are buying (ads),' said Michael Parker, co-president of Sony Pictures Classics, whose film 'Amour' is also up for best picture.

Critic Anne Thompson of Indiewire said this year's extravagance is due to the fact that big studios have high hopes for their films. Amid her swag pile are 'Wreck-It Ralph' plastic fists, a toy bow and arrow from 'Brave,' and a printed page of the John Williams score from 'Lincoln.'

'The factors here are a) the studios involved and b) big hit movies that had extra money,' she said. 'And the fact you have a close race between two big studio movies. They have reason to believe they have a chance to win.'

Such gifts are strictly forbidden by the Academy of Motion Picture Arts and Sciences. But for studios, the stakes are high, and they've been creative in working around the rules to give their movies the best spotlight possible. A best picture win can boost a film's commercial appeal and solidify relations with big-name actors and directors.

This year, top Oscar contenders 'Argo' from Warner Bros. and 'Lincoln' from Disney pitted two deep-pocketed rivals against each other in what some say was an unprecedented level of Oscar campaigning. There was even some targeted sniping about the films' bending of historical facts.

Part of what's behind the seemingly unrestrained lobbying is that this year, an unusually large number of best picture nominees are also doing well at the box office, giving the studios dry powder for their campaigns.

Six of the nine contenders for the top Oscar have reaped $100 million or more in ticket sales domestically, and collectively they've earned $309 million since the nominations Jan. 10, according to Hollywood.com. This record-setting 'Oscar bump' dwarfs the $111 million the nine best picture nominees made between the nominations and the awards ceremony last year. It also trumps the season that 2009's megahit 'Avatar' was in the running, when 10 nominees brought in $204 million in bump.